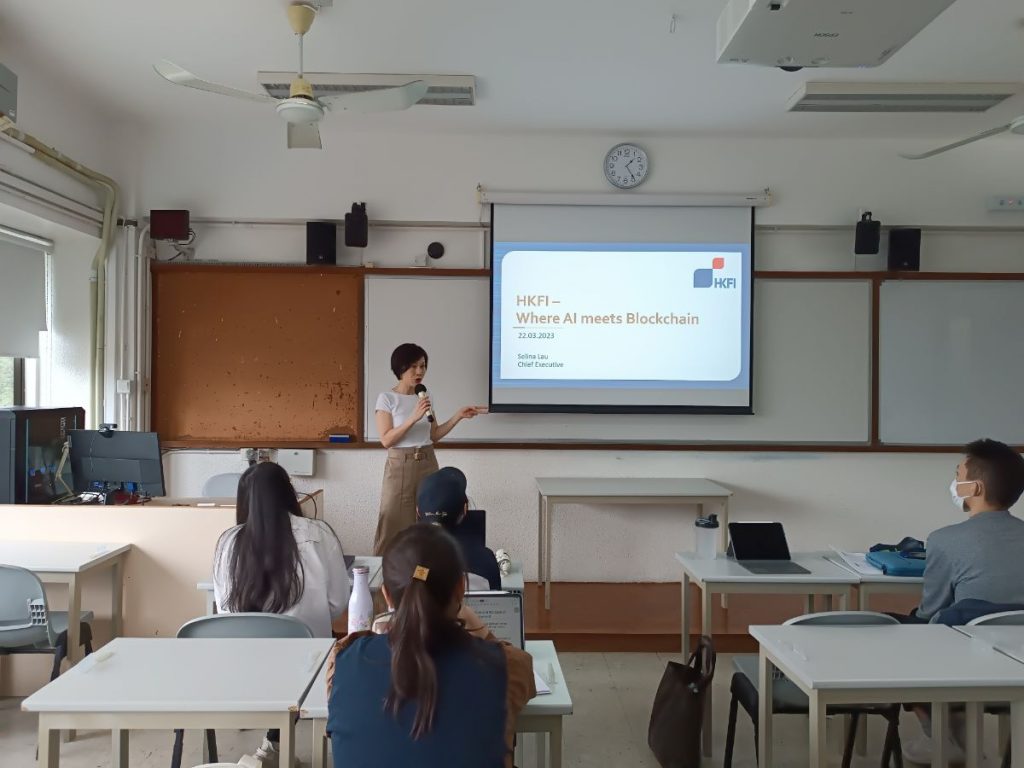

Bachelor of Science (Honours) in Actuarial Studies and Insurance (BSc-AIN) is pleased to organize a guest lecture titled “Where AI meets Blockchain” on 22 March 2023. BSc-AIN is delighted to invite Ms. Selina Lau, Chief Executive of the Hong Kong Federation of Insurers (HKFI) to share about the applications of artificial intelligence and blockchain in insurance industry. Through the guest lecture, students gained a deeper understanding on the latest developments of InsurTech.

News

22

Mar, 2023